B2b Travel Payments: It’s Time To Improve The Experience – Mastercard

Fran is excited – she’s planning a reunion getaway for her college friends. Fran has researched flights, hotels, car rentals, restaurants, and entertainment, and chosen Du Journey, an online travel agency, to help her with the bookings.

Since Fran uses her smartphone to buy everything from daily coffee to new shoes, she’s certain this online travel payment experience will also be a breeze.

Fran is disappointed – the travel agent couldn’t be more helpful, but in terms of payments, the agency acts only as the intermediary for all the suppliers involved in Fran’s trip.

Her card details are passed on to the airlines, hotel, ticket brokers, and the other merchants—making her feel less secure. Equally confusing from Fran’s perspective, trip management is not as simple and straightforward as she’d like.

She has multiple charges on her card statement, from suppliers other than Du Journey, and she’s not certain who to call if she has a change in plans or runs into trouble with a booking.

Fran’s travel agent isn’t happy either – as the global travel industry has grown into a $2.2 trillion industry, the number of travel providers that Du Journey relies on has expanded significantly. In addition to well-established brands, they work with unfamiliar new suppliers to deliver the desired experiences to their clients.

Because Du Journey has a pass-through payment model, it is the airlines, hotels, tour operators and various smaller suppliers that are charging Fran’s card. The travel agent has worked hard to earn Fran’s loyalty and now needs to manage her queries regarding the numerous charges she can now see on her statement.

What if a supplier defaults or misprocesses a booking? Or loses Fran’s information in a data breach? Fran will blame Du Journey for the failure—and future business goes out the window.

Travel suppliers, meanwhile, are worried about their margins – the growing volume of travel-related payments is forcing travel suppliers to shoulder an increasingly higher risk burden related to fraud and charge backs, and associated administrative work.

It seems that business to business payments across the travel space have a long way to go to catch up with the speed, simplicity and convenience delivered in the consumer world,

There must be a better way to give Fran the frictionless payment experience she expects, make Du Journey the merchant of record, while simplifying how the agency can pay suppliers and reduce the risk and workload.

Industry opportunity and risk have never been higher

The global travel industry has experienced continuous growth over the last decade. In 2017, worldwide annual air passenger numbers topped four billion for the first time. That number is expected to nearly double to 7.8 billion passengers by 2036.

Millennials and Generation Z are key drivers of this skyrocketing growth. Adults aged 18-34 travel the most often – 35 days a year for millennials – and are likely to spend more money on vacations than any other age group.

Young adults, in particular, place high demands on the online travel purchase experience. These digital natives use social media and websites as their primary sources for travel inspiration and information, and gravitate naturally to using online travel agencies.

They expect to make seamless travel transactions from any smart device – phone, tablet, watch, or even their digital assistant – and expect their personal information will be secure.

Given the growth in travel bookings, the new players entering the market, emerging regulations, and evolving consumer expectations for service, travel merchants are feeling extreme pressure, especially in the B2B payments space.

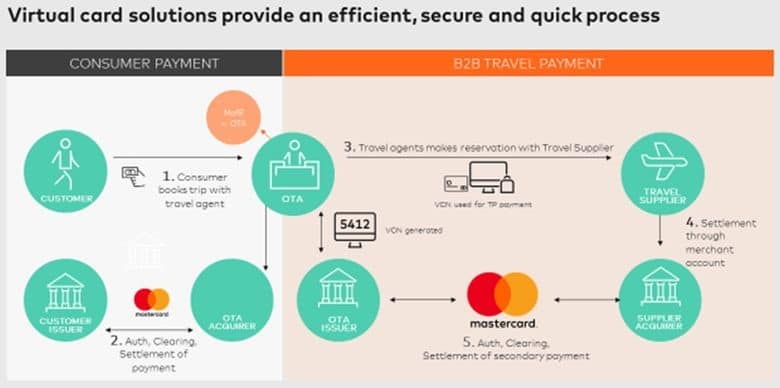

Typically, there are two types of B2B payment flows.

- The pass-through model: The travel agency facilitates the transaction and passes the card information to suppliers who then settle the payment directly with the consumer. This model subjects the consumer to a higher risk of data exposure. Moreover, consumers have to deal with multiple merchants, many of them unknown to them, which can be confusing and frustrating.

- The merchant model: More and more travel agencies are turning to the merchant model. The travel agency is the merchant of record, accepting the customer’s payment, authorising the transaction, and supplying the booking. The agency then arranges secondary payment to the various suppliers. These payments typically rely on legacy payment methods such as cash transfers. Such payments result in long settlement periods, poor reconciliation methods, and lack of cash flow visibility.

Securing these secondary payments is also a concern. Traditionally, agents and suppliers have conducted due diligence and established formal contractual obligations when working with new partners.

This is becoming more difficult and time-consuming as the network of travel suppliers expands. If contracts are not properly negotiated, agencies become susceptible to higher risk exposure if one of the new partners defaults.

Over the last 17 years, the total loss due to airline default has been more than $100 billion, while agency default equates to roughly $2.5 billion.

Despite considerable innovation in the travel space, especially from the large online players, B2B travel payments have continued to lag what is otherwise a growing and dynamic market place. All concerned—consumers, travel agencies, and travel merchants are calling out for a better experience.

Virtual cards: an agent of real change

Virtual cards are digitally-generated single use card numbers that not only provide a more secure way to conduct B2B travel payments, but also mitigate many operational inefficiencies regularly faced by B2B travel organisations.

Partners who accept virtual cards can benefit from payment assurance to ensure payments on a transaction-by-transaction basis. Through this assurance, industry players can establish dynamic contracts between different parties.

This gives each party more confidence when working with unfamiliar partners. It also means that relationships between parties can be more agile, faster, and secure without the lengthy process traditionally required when setting up new relationships.

Virtual cards extend across the entire travel value chain to deliver lower risk and better experiences for suppliers, agents and customers. Suppliers are guaranteed payments; agents are protected against non-delivery; and customers are assured of receiving the services they expect.

How virtual cards work

Virtual cards are random, digitally generated, single use card numbers that are linked to a base account. A unique number is used for each booking or payment transaction making them a secure way to conduct B2B payments.

Virtual cards work in much the same way as a regular payment card but without the plastic.

They are accepted anywhere traditional cards are accepted. Being virtual, the card details simply exist as digital information to facilitate a single-use transaction.

It can only be used for the reservation/ transaction to which it was assigned and can be set to expire after a specific length of time or level of expenditure. Finally, it is supported by existing payment technologies used for physical card payments.

Here are four ways that virtual cards can help improve the entire travel ecosystem:

- Virtual cards recognise the consumer is king

The travel industry is driven by consumers with a thirst for rich new experiences and lasting memories. To meet their expectations, travel agents and suppliers strive to optimize their entire journey, including the payment experience.

Virtual cards can help to drive high rates of customer satisfaction in three ways. First, they enable customers to pay how they want. Nearly half of consumers will abandon a transaction if they can’t pay using their preferred method of payment.

When travel agencies pay suppliers by means of virtual card numbers, consumers can use their preferred payment option and suppliers don’t have to assume the expense of accepting the myriad of global payment methods.

Secondly, virtual cards nurture travel network growth—and greater consumer choice. Due to their global acceptance and payment assurance, virtual cards support stronger partnerships between agents and suppliers. Agents are more likely to expand their network of supplier-partners – giving consumers a wider variety of flights, hotel options, and travel experiences from which to choose.

Finally, virtual cards help meet the consumer’s desire for secure transactions and data privacy. Unlike traditional cards, the customer’s payment details are not transferred between agents and suppliers, reducing the risk of data compromise.

- Virtual cards put reconciliation on autopilot

A key benefit of virtual cards is to help automate and simplify the administration of B2B payments. Each payment transaction is associated with a unique ID number that can be automatically linked to the booking reference information.

These numbers include data such as the invoice number, purchase order number, reference number, and more. Information is available much faster and in more detail, whilst removing the administrative burden associated with other manual payment methods.

This saves time and costs for agencies and suppliers.

- Virtual cards are purpose-built for compliance

The importance and complexity of regulation and compliance in travel payments is amplified by the global nature of travel and diversity of payment mechanisms—imposing costs and risk for all parties in the payment flow.

The single-use nature of virtual card numbers means there is no consumer card data to be stored, which supports an organization’s efforts to protect key payment data. Travel parties can process and transmit personal and payment data in a safer and more secure manner, facilitating greater confidence.

In addition, due to their increased security, virtual cards are not subject to the same regulatory requirements as traditional payment methods under the EU Payment Services Directive (PSD2) and Strong Customer Authentication initiatives. This helps reduce the risk and cost associated with data regulatory compliance.

- Virtual cards fight fraud

Fraud is a growing problem in the travel industry. As global travel networks expand across new segments and markets, the need to actively minimize and manage fraud becomes more critical. Virtual cards are a highly effective solution.

Their one-transaction, one-use payment process has been proven to significantly reduce the instances of fraud across the hotel and airline industries.

In addition, a travel business can set transaction limits for each 16-digit number, allocate expiry dates of use, and impose restrictions to prevent the misuse of the payment details.

Unlocking growth opportunities for the entire industry

Mastercard partners with players from across the industry to deliver fresh ways for travel organizations to succeed in a dynamic ecosystem.

From virtual accounts to fraud management, Mastercard is pioneering innovative solutions that drive efficiency, deliver simplicity and offer flexibility. Is it time for your travel organization to rethink its approach to B2B payments?

Working with a partner like Mastercard can help you discover new ways to unlock growth, improve payment security and control, increase transparency, assist with regulatory compliance efforts, and deliver a seamless experience across the travel payments journey.

Learn more about Mastercard

[related_post]Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Airlines suspend Madagascar services following unrest and army revolt

Qatar Airways offers flexible payment options for European travellers

TAP Air Portugal to operate 29 flights due to strike on December 11

Air Mauritius reduces frequencies to Europe and Asia for the holiday season

Airbnb eyes a loyalty program but details remain under wraps