OAG: Central Asia is the world’s fastest growing air market

Central Asia is far of being a massive aviation market in the world. However, it is now the fastest growing, according to the latest data compiled by aviation consulting company OAG.

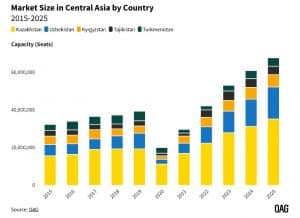

With just 33.7 million scheduled airline seats in 2025, Central Asia is outpacing every other global market in terms of expansion, according to OAG’s historical airline capacity data spanning two decades. Over that period, total airline capacity in Central Asia has surged by nearly 500%, translating into a compound annual growth rate (CAGR) of 7.7%—about two percentage points higher than South Asia (the world’s second fastest growing air market) and five points above the global average.

The growth has been broad-based, encompassing both domestic and international travel. Domestic capacity has expanded from 4.9 million seats in 2005 to 32.9 million in 2025, representing an average annual increase of 10%.

Two giants: Kazakhstan and Uzbekistan

International capacity has followed a similarly strong trajectory, rising from 6.4 million seats to 34.5 million over the same period, with an average annual growth rate of 8.8%. Together, these trends underscore the scale and durability of Central Asia’s aviation boom.

Kazakhstan dominates the regional aviation landscape, accounting for more than half of all airline seat capacity, despite representing just 25% of Central Asia’s population based on the latest United Nations data.

Uzbekistan ranks second, with 25% of total capacity, while also being the region’s most populous country, home to 37.1 million people—roughly 44% of Central Asia’s population. The region’s demographics further reinforce its growth potential: the average age is just 26.6 years, suggesting sustained demand for air travel as incomes rise and economies continue to develop.

Market liberalization has been a critical catalyst, opening Central Asian skies to low-cost carriers and foreign airlines and fundamentally reshaping competition.

The region has also benefited from geopolitical shifts, particularly the rerouting of Russian outbound travelers through Central Asia following airspace closures linked to Russia’s war in Ukraine. The latter cut off effectively direct access to Europe for Russian carriers. Today, 125 airlines operate in Central Asia, although carriers based in the region still account for 71% of total capacity.

Low-cost carriers have been among the most transformative forces. In 2015, Central Asia had the lowest LCC penetration rate in the world at just 4.6%. By 2025, that share has climbed to 21%, with further growth expected.

The expansion of low-cost services has made air travel more affordable and accessible to a growing middle class, unlocking demand that had long been suppressed. Kazakhstan’s FlyArystan exemplifies this shift: the carrier has become Central Asia’s largest airline, operating 10 million seats and capturing 15% of the regional market. Its sister airline, Air Astana, follows closely with a 14% share. Other significant players include SCAT Airlines, Uzbekistan Airways, and foreign competitors such as Ural Airlines, Turkish Airlines, and Aeroflot.

Russia war in Ukraine seen as an opportunity for Central Asia

Network strategies vary widely across the region. Domestic aviation dominates in larger, geographically expansive markets, accounting for 71% of Kazakhstan’s capacity and 66% of Turkmenistan’s.

By contrast, international connectivity—particularly to East and Central Europe—plays a more prominent role for Tajikistan, Uzbekistan, and Kyrgyzstan. Despite shared borders, intra-regional connectivity remains limited: only 4% of Central Asia’s total seat capacity is allocated to flights within the region, highlighting an underdeveloped cross-Central Asian network.

Russia remains the most important international market for Uzbekistan, Tajikistan, and Kyrgyzstan. It is driven by labor migration, expanded aviation freedoms, and the strategic reorientation of Russian carriers toward eastern markets. Kazakhstan, however, has pursued a more diversified approach, actively reducing its reliance on Russia while expanding capacity to Turkey, the United Arab Emirates, and destinations across Asia. Increased competition from non-Russian airlines has also altered traffic flows, with routes that once transited Russia now shifting to hubs such as Istanbul, Dubai, and Abu Dhabi.

Uzbekistan may be following a similar path. Air capacity between Uzbekistan and the UAE has increased by 376% since 2019, fueled by a new bilateral air services agreement and rapidly rising travel demand. The surge points to a broader geographic focus in the country’s aviation strategy.

Several forces are converging to sustain Central Asia’s aviation momentum: liberalized markets replacing state-controlled airline systems, rapid growth in low-cost carriers, significant investment in airport infrastructure, and rising levels of economic activity and tourism. With large populations, improving incomes, and historically underserved air networks, Central Asia holds substantial latent demand—positioning it as one of the most promising aviation markets globally.

All data cited in this article is sourced from OAG Schedules Analyser.

Related News Stories: Intra-ASEAN travel strengthens Southeast Asia's tourism OAG tells which are the leading global airline in punctuality in ... Thailand's flagship high-speed airport rail project on the brink of ... Brazil's Azul gets Chapter 11 restructuring approval US-Canada flight demand plunges Etihad to join in 2026 a crowd of international airlines flying to ... DOJ backs cruise lines' legal fight against Hawaii tax Hong Kong Airlines optimises GDS costs with Accelya Royal Jordanian Airlines inks new Avolon lease agreement for ... Delta settles $8.1 million pandemic payroll case

newadmin

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Euromonitor International unveils world’s top 100 city destinations for 2025

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports