Overseas travel intentions to Europe on the decline for summer 2025

Is Europe less attractive this summer season? Although the demand remains sustained, the European Travel Commission (ETC) latest Long-Haul Travel Barometer (LHTB 2/2025) points to a slight declined for summer 2025.

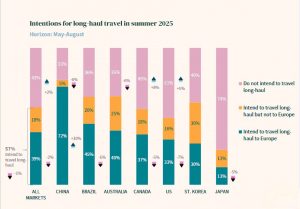

The report published by the European Travel Commission and Eurail BV highlights that only 39% of the respondents plan to visit Europe—down from 41% in 2024. While 57% of respondents across key overseas markets intend to travel internationally between May and August.

China is back to Europe

This decrease is most evident in the United States, Brazil, Canada, and Japan, where economic uncertainty and rising travel costs have impacted sentiment. In the US, just 33% of respondents intend to visit Europe, a 7% drop from last year, with affordability and political unease cited as key deterrents.

Brazilian interest has also declined by 6%, although enthusiasm remains strong among younger and higher-income travelers. In Canada, the share of those planning a European trip has fallen 5% to 37%, while Japan shows the lowest interest at 13%. The Japanese market is ageing which explains a cautious outlook from consumers. A weak Japanese Yen acts also as a deterrent factor. Meanwhile, sentiment in South Korea remains stable, with 30% considering Europe, focusing mainly on France, Spain, and Italy.

In contrast, China stands out as the only market with a major surge in travel intent. Driven by economic recovery and evolving consumer priorities, 72% of Chinese respondents now plan to visit Europe. This represents a 10% year-on-year increase.

Australia also shows a modest increase, with 40% of respondents indicating plans to travel to the region.

Europe to expensive?

The perception of Europe as an expensive destination remains the top barrier. Nearly half of those not planning to visit point to high spending, a 7% rise from 2024. Cost concerns are especially acute in the US and Brazil. Limited vacation time and a preference for domestic trips also play a role in markets like Japan and Australia. However, concerns about the Russo-Ukrainian war have notably declined, with only 4% citing it as a deterrent this year.

Travel patterns are also evolving. More travelers are opting for earlier summer departures, with interest in May and June trips rising from 24% to 34%. Budget preferences are shifting as well: fewer respondents now plan to spend over €200 per day, while 40% expect to spend between €100 and €200.

Dining remains the top spending priority (65%), followed by tourist activities and shopping, Transport budgets remain high (41%) due to the continued popularity of multi-destination itineraries.

European Travel Commission President Miguel Sanz stressed the importance of boosting Europe’s competitiveness and accessibility. He encouraged promoting off-season travel and lesser-known destinations to maintain the region’s global appeal.

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Euromonitor International unveils world’s top 100 city destinations for 2025