Phocuswright reveals the world’s largest travel markets in volume in 2025

Phocuswright‘s Travel Forward: Data, Insights and Trends for 2026, sponsored by Travel Guard, provides broadscale insights into a global travel market which is slowly approaching the US$ 2 trillion in bookings.

The report offers essential data for understanding industry trends and growth. Featuring highlights by segment, channel, consumer behavior metrics and more, this report equips industry stakeholders with the key data and trends needed to navigate the rapidly evolving travel landscape. All market sizing data for 2025 are projections.

Global travel extended its post-pandemic expansion in 2025, with total gross bookings projected to reach $1.67 trillion, according to Phocuswright, pushing the industry well beyond its pre-2020 benchmarks.

While growth has cooled from the explosive rebound of 2023 and 2024, demand remains broad-based and resilient, underscoring travel’s position as one of the world’s most dynamic consumer sectors.

The recovery is being fueled in large part by a strong return of international travel. Record outbound flows from Asia Pacific are reshaping global travel patterns, while Europe and the Americas continue to deliver steady volumes across leisure and corporate segments.

Even as travelers contend with inflation, high interest rates and persistent geopolitical tensions, Phocuswright data shows that spending on experiences continues to take priority over discretionary goods, keeping travel firmly on a growth trajectory.

A US$11.7 trillion power in global GDP

At a macroeconomic level, the scale of the sector is striking. Travel and tourism is expected to generate more than $11.7 trillion in global GDP in 2025, accounting for roughly one in every ten dollars spent worldwide and supporting an estimated 371 million jobs. International visitor spending alone is projected to hit a record $2.1 trillion this year, finally surpassing its pre-pandemic peak. Yet Phocuswright cautions that the rebound remains uneven, with clear differences in maturity and momentum across regions.

North America and Europe are entering a phase of stabilization after two years of rapid expansion. These regions continue to benefit from strong domestic demand and well-developed travel ecosystems, but growth rates are moderating.

Asia Pacific, by contrast, remains the industry’s primary engine of expansion, driven by population scale, rising incomes and the full reopening of international travel corridors. Emerging markets in Latin America and the Middle East are also accelerating, albeit from a smaller base, as investment in aviation, hospitality and digital infrastructure pays dividends.

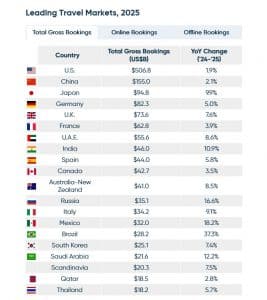

At the country level, the United States remains the world’s largest travel market, with bookings forecast at $506.8 billion in 2025. However, its growth has slowed as faster gains shift toward Asia and other emerging economies. China and Japan rank as the second- and third-largest markets globally, with Japan standing out for a near 10% year-over-year surge—one of the strongest rebounds among major travel economies.

In Europe, Germany, the United Kingdom and France continue to anchor regional demand, providing stability even as growth is outpaced elsewhere. The United Arab Emirates, India and Saudi Arabia are leading gains across the Middle East and parts of Asia, reflecting aggressive tourism strategies and expanding middle classes. Meanwhile, double-digit growth in Brazil, Mexico and Russia highlights a broader rebalancing, as rising markets capture an increasing share of both total and online travel bookings.

Phocuswright’s 2025 outlook points to an industry that is no longer defined solely by its traditional powerhouses. While mature markets remain critical in scale, the center of gravity is gradually shifting toward faster-growing economies, signaling a more diversified and competitive global travel landscape in the years ahead.

For more in-depth analysis and data including longer-term predictions, travel operators can become an Open Access subscriber to use the Phocal Point market sizing data tool and to access all reports in the Phocuswright Research library.

Related News Stories: Partner News - TravelMole DidaTravel - TravelMole

newadmin

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Euromonitor International unveils world’s top 100 city destinations for 2025