The Big Mac Index shows the dollar undervalued with most European currencies

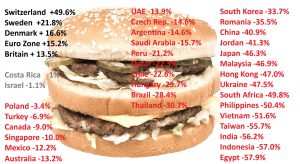

Undervalued compared to the currencies of mature European economies. Overvalued compared to most currencies in Asia, Latin America, and the Middle East. Every year, The Economist, one of the world’s most prestigious weekly magazines, publishes its Big Mac Index. It provides an instant benchmark of the dollar’s value compared to the rest of the world.

The principle of the Big Mac Index is simple. The Economist calculates the price of a Big Mac—a standardized item made of the same ingredients—in countries around the world. Base 100 represents the United States, where a Big Mac costs USD 6.01. By converting the price of a Big Mac in other countries, The Economist can assess how undervalued or overvalued various currencies are compared to the dollar.

The Economist explains that the Big Mac index was invented in 1986 as a lighthearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services in any two countries.

To no one’s surprise, the most overvalued currency based on the Big Mac Index 2025 is Switzerland’s. At CHF 7.20 (approximately USD 9.00 at the exchange rate on July 17), The Economist indicates that the Swiss franc is 49.6% overvalued against the US dollar. Any traveler visiting Switzerland has likely realized how expensive everything is in that country—from a café crème costing on average CHF 4.84 (even CHF 6 in Zurich) to McDonald’s iconic hamburger.

Of the seven countries with overvalued currencies according to the Big Mac Index, six are in Europe. Besides Switzerland, Norway’s currency is overvalued by 22.1%. It is followed by Sweden (21.8%), Denmark (16.6%), the Euro zone (15.2%), and the UK (13.5%). The only overvalued currency outside of Europe is in Latin America: in Uruguay, a Big Mac costs 315 pesos, making its currency 29.6% overvalued against the US dollar.

All Asian, Latin American, and Middle Eastern currencies fare poorly compared to the US dollar in the Big Mac Index. While the price of a Big Mac is nearly equal to that in the US in Costa Rica and Israel, currency undervaluation can reach extreme levels—down to 57% in Indonesia and 57.9% in Egypt. These two countries have actually the most undervalued currencies according to the index.

Another notable drop in currency exchange rate happens in Japan. The weakening yen means the currency is now down 46.3% against the US dollar. Meanwhile, the currencies of Canada and Mexico—the US’s largest trading partners—remain undervalued by around 10%.

Burgernomics was never intended as a precise gauge of currency misalignment, merely a tool to make exchange-rate theory more digestible tells the Economist. Yet the Big Mac index has become a global standard, included in several economic textbooks and the subject of dozens of academic studies. It remains an interesting—though not scientific—benchmark for currency trends. And it’s an unusual way to see just how far a US dollar can stretch around the world!

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Euromonitor International unveils world’s top 100 city destinations for 2025