Brexit will ‘lead to loss of 2.3 million visitors to UK’

Market researcher Euromonitor is predicting 2.3 million fewer visitors to the UK over the five years up to 2020 following the UK’s vote to leave the European Union.

It said that as the UK had entered a ‘period of uncertainty with many unknowns’, it forecast a 2% drop in GDP over the next five years, with the biggest impact felt next year.

The GDP would not return to the baseline until 2023, said Euromonitor.

Head of travel research Caroline Bremner said: "Destination branding and consumer desire to travel would be hit hard by the uncertainty Brexit would entail in the short to mid-term.

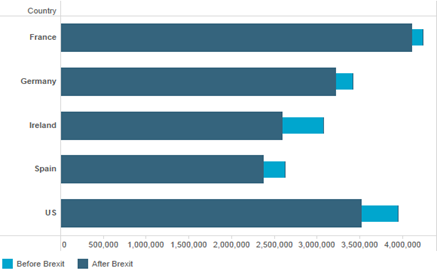

"EU source markets, such as Ireland, Germany and Spain along with the US would experience the sharpest forecast change in volume. However, a pound slump after Brexit would help to entice visitors to the UK."

The UK is high up on the scale of popular destinations, ranked sixth globally in 2015, with an impressive 35.4 million international trips, worth £28 billion to the UK economy, said Euromonitor.

It has a high dependency on Western and Eastern Europe for its international tourists, with both regions accounting for 73% of all inbound tourism in 2015.

France is the UK’s biggest and robust source market, with 3.7 million visitors to the UK in 2015, and has exhibited a high level of resilience to external factors in turbulent times.

Based on previous travel behaviour during times of uncertainty and weaker economic performance at home, Germans and Americans are less likely to travel to the UK, and Euromonitor expects that each country will send half a million fewer people here between 2015 and 2020 to reach 3.3 million and 3.5 million respectively.

Following the global recession in 2008, it took eight years for UK outbound demand to recover to its original levels pre-crisis, only achieving levels of over 78 million outbound trips in 2015.

In value sales terms, the outbound market lost over £10 billion from its peak in 2008 and bottomed out in 2013 when the outbound market started to pick up again thanks to pent-up demand and a stronger economy.

"The sharp fall was not just a result of demand collapsing, but also the removal of unprofitable low-costs deals and players, with major tour operators reducing supply to maximise average transaction prices," said Euromonitor.

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Euromonitor International unveils world’s top 100 city destinations for 2025