Smoldering Cambodia-Thailand border conflict drags down tourism on both sides

The renewed flare-up between Cambodia and Thailand over their disputed border, following a fragile ceasefire, is taking its toll on the tourism sectors of both countries.

The effect is relatively mild in Thailand as its northeastern region- next to Cambodia border- is a small player for international visitors. However the impact is being felt most acutely in Cambodia.

Cambodia tourism troubles

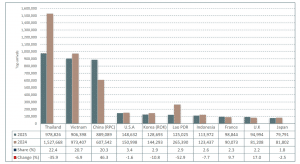

The total visitor numbers from January to September to Cambodia plunged 8.8%. While air arrivals rose a robust 22.4% to 2.1 million, land travel collapsed by 26.5%—a drop of roughly 800,000 visitors.

Cambodia recorded just over 2.2 million land entries over the nine-month period, down from 3.04 million a year earlier. The data reflects in fact the full closure of land borders between the two neighbors since June.

Cambodia’s tourism decline began immediately after the border shutdown and accelerated through the summer, reaching levels not seen since 2021 during the height of the pandemic. Unsurprisingly, arrivals from Thailand—Cambodia’s largest source market—fell more than 35% from January through September and plummeted 91% in September alone.

Of Cambodia’s top ten source markets, seven are now in retreat. Visitors from Laos has dropped sharply as travelers can no longer transit through Thailand.

South Korea has also tumbled, hurt by a wave of cyber-crime scams in Cambodia that involved the abduction of thousands of Korean nationals, conducting to even the execution of some of them. In September, all Asian markets dropped -China and Taiwan excepted.

The drop is definitely linked to scams. They have a chilling effect on Asian tourists, who are very sensitive at safety issues. While Japanese arrivals declined “only” by 2.5% from January to September, the number was down to -15.2% in September.

Redefining Cambodia’s narrative

European markets, however, remain a bright spot. Arrivals surpassed 500,000 by the end of September, up 12.3% year-on-year. French visits rose 9.7%, approaching the 100,000 mark while the UK grew by 17% and Germany by 7%. If total tourist arrivals from the USA declined by -1.6%, it is more than compensated by a buoyant Chinese outbound market, up 46%.

The difficult climate—far beyond the scope of standard destination marketing—demands a new approach, explained Kim Minea, CEO of the Cambodia Tourism Board during WTM London 2025. He acknowledged that the CTB must significantly ramp up its promotional efforts.

“We’re holding roadshows to meet travel agencies. It is essential for gathering extensive on-the-ground feedback. But we need to return to something simple and powerful, centered on Cambodia’s greatest asset: its people. A campaign built around this could be deeply human, impactful, and instantly recognizable.”

The tourism crisis is consequently seen as an opportunity to reposition the Kingdom’s image. Minea wants to spotlight under-promoted strengths. This includes Cambodia’s largely undiscovered cuisine and its coastline—particularly by building three-day packages around Kep and Kampot along the Coast. “We have to promote Cambodia as a complete, unified destination, not just Angkor, even if it remains our icon,” he said.

In fact, despite having its own international airport with a surge in international arrivals of 10% for the first 9 months of 2025, the Siem Reap region is losing travelers, showing that a large part of visitors used to travel to the city and Angkor by road from Thailand. From January to September, total foreign visitors’ arrivals grew by a modest 0.9%. However, in September alone, arrivals declined by 25.7%.

Thailand rolls out support for affected Northeastern provinces

On the Thai side, the border tensions have had a more localized impact, though they coincide with a broader slowdown.

Thailand welcomed 26.69 million international visitors between January and October 2025—a 7.2% decline. Asian markets were hit hardest, down 14%, with the steepest drops from Cambodia (-46.5%), China (-34%), and Laos (-24%).

Europe remains Thailand’s saving grace. Arrivals rose 14% to more than 6.2 million over the first ten months. The UK, France, Germany aligned growth rates comprised between 11% and 15%. Poland arrivals grew by almost 30%.

The Americas and Australia arrivals showed also growth, albeit less buoyant than for Europe. Visitors from the Americas were up by 7.55% with the USA up by 5.4% and Canada up by 4.7%.

Australia was up 6.8%. The Middle-East showed disappointing results due to a surprising drop from its two largest outbound markets. Saudi Arabia arrivals were down 5.5% and the UAE by 0.9% for the first 10 months of 2025.

However, the provinces bordering Cambodia have suffered the most since fighting resumed. International arrivals in Thailand’s northeastern Isan region fell around 5% in the least-affected provinces, but drops exceeded 50% in areas adjacent to conflict zones.

In Surin province, foreign arrivals fell 38% in July, 51% in August, and 15% in September. In neighboring Sisaket, declines reached 19%, 42%, and 20% over the same months.

Although these provinces usually attract far fewer tourists than Thailand’s major destinations, the slump was severe enough to prompt a government intervention.

The relief initiative—called “Check-in, Fun, Wow, East X Northeast”—comes with a 2-million-franc budget and is managed by the Tourism Authority of Thailand (TAT). It funds group travel promotions through accredited operators across seven border provinces: Ubon Ratchathani, Sisaket, Surin, Buriram, Sa Kaeo, Chanthaburi, and Trat. Financial support is available for both transport and accommodation to help jump-start local tourism.

Meanwhile, the two provinces of Chantaburi and Trat located along the Gulf of Siam showed more resilience. While sharing a border with Cambodia, they still recorded a growth of 1.8% in total foreign arrivals during the first 9 months of 2025. The UK even lifted its ban on its nationals to visit Trat in early November.

newadmin

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Euromonitor International unveils world’s top 100 city destinations for 2025