About us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis. Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions. Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms. Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity. Spend at destination: we analyse patterns of ...Read more

Mabrian Technologies - About Us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis.

- Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions.

- Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms.

- Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity.

- Spend at destination: we analyse patterns of Spend for visitors to a destination based on credit and debit card usage (or equivalent digital means). This data comes from the main providers of payment channels.

- Presence and mobility: we monitor presence and mobility of visitors through their mobile devices’ connectivity to antennas located in the destination. This data comes from mobile network companies that are present in the destination.

Company Name : Mabrian Technologies

News & announcements

-

03 May 24

Partner News

Low-cost airlines increase air tickets prices to Spanish destinations this summerAccording to Mabrian’s data, low-cost airline flights fares are behind the increase in average ...Read moreLow-cost airlines increase air tickets prices to Spanish destinations this summer - News & announcements- According to Mabrian’s data, low-cost airline flights fares are behind the increase in average prices for routes to Spain from its five main source markets and to the five favourite destinations of Spanish travellers, rising by 26% and 27%, respectively.

-

07 Feb 24

NEWS

Mabrian: The world’s best countries for international flight connectivityThe UK is the second most connected nation for air travel, according to newly released ...Read moreMabrian: The world’s best countries for international flight connectivity - News & announcementsThe UK is the second most connected nation for air travel, according to newly released data from tourism intelligence firm Mabrian. It released a ranking for the top 10 countries in terms of the number of available seats during the first half of 2024. The US has the best international connectivity with 83.5 million seats followed by the UK with 72.5 million. The analysis, based on flight schedules, reveals a significant evolution in the connectivity landscape. Still, European countries have seen a big increase in connectivity with China since last year, collectively offering 1.98 million air seats. This marks an impressive 190% increase compared to the first half of 2023. China now allows nationals of Spain and four other European Union countries to enter China without a visa for up to 15 days. Top 10 countries with the best international connectivity: United States: 83,540,022 seats United Kingdom: 72,806,356 seats Germany: 53,650,569 seats Spain: 53,402,095 seats United Arab Emirates: 41,829,422 seats France: 41,148,774 seats Italy: 39,233,697 seats China: 35,125,071 seats Turkey: 32,514,540 seats Japan: 28,851,733 seats The total air seats for these 10 countries amount to 482,102,279, contributing to 42% of the global international air seats in the first half of the year. Carlos Cendra, CMO at Mabrian, said: "Anticipating the potential of origin markets regarding their outbound air connectivity is a key factor in identifying where tourist demand will be.” “However, it is essential to analyse each destination specifically". Gavin Eccles, director of air connectivity specialist GE Consulting, says: “The robust outbound markets of the UK and Germany are also experiencing significant growth in seats and connections." “If growth continues, 2024 could surpass 2019 as the year with the highest international connections.”Related News Stories: Mabrian Technologies World's largest cruiseliner preps for maiden voyage World's largest cruise ship joins Royal Caribbean fleet TravelMole – Travel industry community since 1999 World Tourism Organization opens Brazil regional office Stowaway scorpion causes a stir on British Airways flight DidaTravel booking data reveals Chinese New Year insights ... Aer Lingus expands American Airlines codeshare Partner News SalamAir to launch flights to five India cities

-

28 Dec 23

Partner News

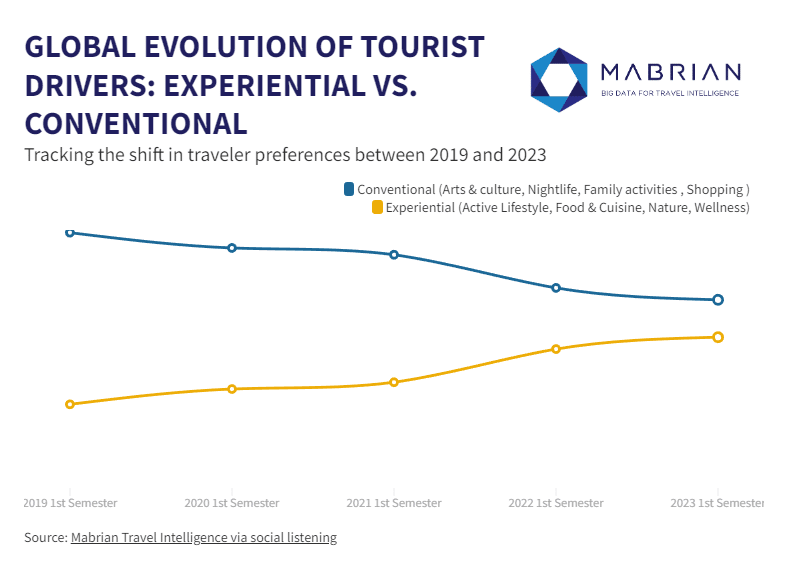

New motivations for travel in Europe: trending destinations in 2024Experiential travel as a motive for a holiday has increased by 8 percentage points ...Read moreNew motivations for travel in Europe: trending destinations in 2024 - News & announcements- Experiential travel as a motive for a holiday has increased by 8 percentage points globally since 2019, with motivations to visit Europe following a similar pattern.

- Northern European countries are better positioned to capitalize on these new demand trends.

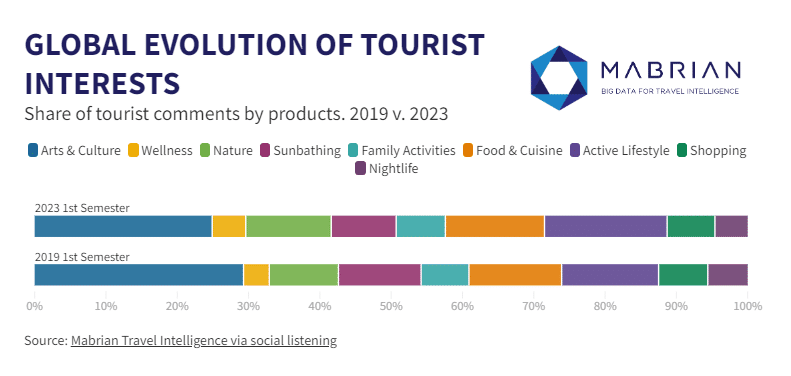

- Towards experiential travel: Mabrian's analysis indicates a global trend towards more experiential and less conventional travel motivations, with an 8% increase in experiential travel since 2019. Experiential tourism encompasses activities such as active, natural, gastronomic, and wellness experiences, while conventional tourism includes culture, sun and beach, family activities, nightlife, and shopping.

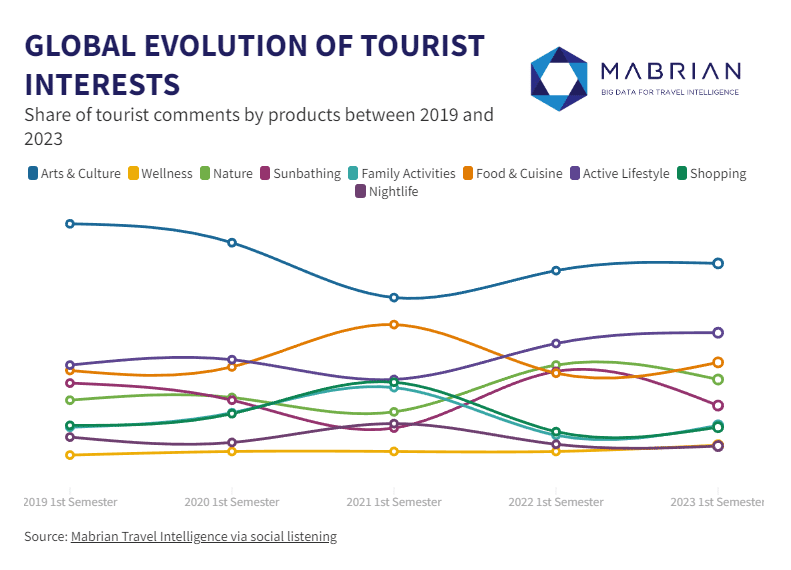

- New european trends reflecting global change: Europe has experienced an equivalent 8% growth in experiential activities from 2019 to 2023, reducing the prominence of conventional motivations. Active and nature tourism emerge as the fastest-growing, gaining 5 and 3 percentage points, respectively.

- Countries best positioned for experiential tourism: Countries in Northern Europe, including Iceland, Norway, Finland, Slovenia, and Switzerland, are better positioned to capitalize on the growing demand for experiential activities, with a share of over 60% in visitor interest.

- Potential trending destinations for 2024: Mabrian identifies Italy as the leading country with the most potential destinations (four), followed by France and Germany with two each. The top 10 trending regions for 2024 also include the United Kingdom and Portugal.

- Piedmont Region, Italy: Notable for destinations like Turin, Stresa, and Alba, Piedmont stands out with a balance of cultural and natural offerings. Gastronomic experiences feature prominently among experiential motivations, coupled with positive trends in flight accessibility.

- New Aquitaine, France: Featuring destinations such as Bordeaux, Biarritz, and Limoges, this region stands out for its oenological and gastronomic products alongside active tourism. The region enjoys good and stable air connectivity.

- East of England, United Kingdom: Including Cambridge, Essex, and Norfolk, this region achieves a balance between cultural and natural offerings, positioning it as a growing destination. Its solid and stable connectivity further supports its appeal.

- To complete the top 10 trending destinations, notable mentions include: Occitania (France), Campania (Italy), North Rhine-Westphalia (Germany), Lombardy (Italy), Emilia-Romagna (Italy), the province of Hamburg (Germany), and the province of Lisbon (Portugal).

-

24 Nov 23

NEWS

Data Appeal acquires majority stake in MabrianItaly based Data Appeal has signed a contractual agreement for 70% of Mabrian Technologies. It ...Read moreData Appeal acquires majority stake in Mabrian - News & announcementsItaly based Data Appeal has signed a contractual agreement for 70% of Mabrian Technologies. It will create the largest specialist travel data intelligence company in Europe. Both companies leverage data analytics and Artificial Intelligence in their segments. Mabrian already has a presence in over 40 countries. Combined, the two companies will have 160 data sources, covering more than 200 countries and a team of analysts specialised in tourism and destination management. The scope ranges from traveller sentiment, mobility, demand, tourist spending and accommodation. Data Appeal is part of the Almawave Group. Santi Camps, CEO of Mabrian said: "For us, joining The Data Appeal Company is a strategic decision with the goal to lead the market globally. “ “A great team has brought Mabrian to where it is today, but now it is time to become part of a solid technology group as Almawave to take advantage of synergies and share know-how." -

16 Nov 23

Partner News

Croatia forecasts a 10% growth in tourism for this low season – Mabrian TechnologiesCompared to last year, Croatia anticipates higher tourism activity during the autumn and winter ...Read moreCroatia forecasts a 10% growth in tourism for this low season – Mabrian Technologies - News & announcements- Compared to last year, Croatia anticipates higher tourism activity during the autumn and winter months, with specific months showing an increase of more than 20%.

- A Seasonal Context with Room for Improvement. Croatia still has room for improvement during the considered low season months. When compared to the context and its closest competitors, the data indicates that the Southeast Mediterranean region is 9 percentage points more dependent on the high season than the average in the nearby Mediterranean, while Croatia is 16% more.

- Promising Prospects for the Low Season. One of the main takeaways from Mabrian's analysis is the promising outlook for Croatia in the coming months. It forecasts a 10% increase in tourism from September to March 24, compared to last year. In terms of growth, Croatia is expected to outperform Italy and Turkey during these months, although it has not yet reached the levels seen in Greece.

- Croatia Well Positioned for Travellers’ Motivations. According to the latest global travellers’ motivations study conducted by Mabrian, there is a consistent growth in experiential motivations for travel, substituting more conventional motivations. Analysis of travellers sentiment and preferences, based on over 400 million interactions on social media, reveals that interests in Active, Natural, Wellness, and Gastronomy experiences are gaining importance over Sunbathing, Family Travel, Shopping, and Nightlife. This positions Croatia with a great opportunity to solidify its leadership in Nature and Active tourism products during the low season, compared to Mediterranean competitors. Additionally, there is an interesting opportunity to further develop Gastronomy and Culture-related activities, which were among the main travellers interests from October to March during the Autumn-Winter 2022-2023 season.

-

13 Oct 23

Partner News

Hotel rate rises: how much is too much? Mabrian TechnologiesThis summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B ...Read moreHotel rate rises: how much is too much? Mabrian Technologies - News & announcements- This summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B distributors respond? What role does tech play?

- Data from travel intelligence provider shows 2023 August prices for hotels were up by 64.03% in North America when compared to 2019.

-

21 Aug 23

Partner News

Experiential travel replaces conventional motivations for travel – Mabrian TechnologiesMabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019 ...Read moreExperiential travel replaces conventional motivations for travel – Mabrian Technologies - News & announcements- Mabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019

- ‘Experiential’ definition includes activities such as Wellness, Active & Lifestyle, Nature & Food and Cuisine.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination.

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination. -

01 Aug 23

NEWS

Europe could reduce CO2 by 1 million tonnes switching domestic flights to railTravel Intelligence firm Mabrian Technologies has crunched the numbers in the big plane vs train ...Read moreEurope could reduce CO2 by 1 million tonnes switching domestic flights to rail - News & announcementsTravel Intelligence firm Mabrian Technologies has crunched the numbers in the big plane vs train debate. It carried out a study on the potential impact of replacing domestic flights of less than two and a half hours up to a maximum of 500 km, with high-speed trains. The study analyses the savings in CO2 emissions if it became a requirement across Europe. This has already started to be implemented in France. The report found there are 554 domestic flight routes in Europe which would qualify. In 2023, they will carry around 44 million passengers and produce around 2.3 million tonnes of CO2. If they shifted to high-speed trains it could reduce the environmental impact by an average of 48%. This would translate into a saving of more than one million tonnes of CO2 in just one year. This is equivalent to more than 200,000 cars running continuously for 12 months, Mabrian says. For a comparative calculation, Mabrian has looked at the type of electrical energy and its sources, which power the railway system in each European country. It followed the methodology published by the EcoPassenger report. This sets out an ambitious transition towards sustainable mobility, involving the adoption of clean and green technologies. Some countries are further advanced in this than others. Germany, for example, has invested in modernising its rail infrastructure and adopting cleaner technologies. Sweden has been a leader in the use of renewable energy sources such as hydropower and wind power in rail transport. The study reveals five European countries that would achieve the greatest CO2 savings if this transition were to take place. Top is Spain, with a potential saving of 360,000 tonnes of CO2 per year. Then it is Germany, France Italy and Sweden. The analysis has focused only on domestic air routes within each country. So, potential savings would be much greater if all air routes of 500km or less were also considered. Still, to meet the requirements, the cost of upgrading rail infrastructures would require significant investment. Some countries may not have the resources to finance it. Carlos Cendra, Marketing Director at Mabrian, said: "While this analysis may seem unrealistic, we believe in demonstrating the efficiency of decisions through data.” With this analysis, we have quantified the potential savings from taking steps in that direction.” -

24 Jul 23

Partner News

Mabrian enters next phase of strategic growthMabrian announces strategic growth plan as part of evolution to become the number one ...Read moreMabrian enters next phase of strategic growth - News & announcements- Mabrian announces strategic growth plan as part of evolution to become the number one travel intelligence tool globally.

- In addition to the Middle East and North America push the company will also expand further into providing services to hotels, airlines and other private sector businesses.

- Diana Munoz joins Mabrian as a Strategic Advisor to lead the company’s new strategy and contribute to its growth.

-

05 Apr 23

NEWS

Europe hotel rates rise well above inflationTravel intelligence provider Mabrian conducted a Europe hotel price analysis of 20 destinations. It found ...Read moreEurope hotel rates rise well above inflation - News & announcementsTravel intelligence provider Mabrian conducted a Europe hotel price analysis of 20 destinations. It found European hotel rates are on the rise across most categories and destinations, eclipsing inflation. In general terms, Barcelona, Brussels, and Rome are the destinations with the highest increase in hotel rates. These ranged from 30% to 33% on average. Meanwhile, Ljubljana, Madrid, and Tirana saw the lowest Europe hotel price increases. Mabrian also notes that Barcelona is the city where prices have increased the most compared to Easter 2022, with a 43% increase for three-star hotels. In four-star hotels, the highest price growth is in Brussels, with a 34% increase. Mabrian cites Zagreb, Warsaw, and Tirana as the most competitively priced destinations for all three categories of hotels over Easter. Carlos Cendra, Director of Marketing & Sales at Mabrian, said: "While hotel prices are rising sharply, we must look at this rise in the context of inflation” “In addition, we have to account for the increase in staff operating costs.” “All this is combined with a strong demand for travel, which pushes prices up." -

02 Feb 23

Partner News

Ranking of destinations that have reactivated their direct air connections with China for 2023 – Mabrian TechnologiesBudapest, Lisbon and Warsaw lead the list of capitals by rate of recovery of ...Read moreRanking of destinations that have reactivated their direct air connections with China for 2023 – Mabrian Technologies - News & announcements- Budapest, Lisbon and Warsaw lead the list of capitals by rate of recovery of air connectivity with China

-

20 Jan 23

Partner News

The fastest growing source markets with flights to Madrid for 2023Mexico and Colombia lead the destinations with the highest growth in air capacity to ...Read moreThe fastest growing source markets with flights to Madrid for 2023 - News & announcements- Mexico and Colombia lead the destinations with the highest growth in air capacity to travel to the Spanish capital in 2023

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico.

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico.

VIDEOS

Exploring Future Trends: Insights from World Travel Market 2023

Join us at the World Travel Market 2023 as we delve into the latest travel trends and technological advancements shaping the industry. We had insightful discussions with international experts in generative AI, blockchain, and legal regulations.

Travel motivations are evolving towards more experiential pursuits. There is an exciting atmosphere and optimistic outlook for the travel sector, especially in Southern Europe and the UK market.

We also share our participation in the WTM Global Trends report, offering a glimpse into the transformative intelligence shaping the future of travel.

💎 https://mabrian.com/

🖊️ https://blog.mabrian.com/

📫 [email protected]

🐦 https://twitter.com/MabrianOfficial

Travel intelligence platform for tourism industry. Real time data observatory providing flights data, hotel data, spend data, tourist sentiment and perception data. Predictive insights for Smart Destinations, Tourist Marketing and Revenue Management.

Travel motivations are evolving towards more experiential pursuits. There is an exciting atmosphere and optimistic outlook for the travel sector, especially in Southern Europe and the UK market.

We also share our participation in the WTM Global Trends report, offering a glimpse into the transformative intelligence shaping the future of travel.

💎 https://mabrian.com/

🖊️ https://blog.mabrian.com/

📫 [email protected]

🐦 https://twitter.com/MabrianOfficial

Travel intelligence platform for tourism industry. Real time data observatory providing flights data, hotel data, spend data, tourist sentiment and perception data. Predictive insights for Smart Destinations, Tourist Marketing and Revenue Management.

-

Exploring Future Trends: Insights from World Travel Market 2023

-

Mabrian at the Tourism Innovation Summit, Seville - A World for Travel sustainability award

-

An Inside Look at Mabrian Technologies' Growth Strategy with Diana Munoz, Strategic Growth Advisor

-

Travel intelligence and smart pricing management - Project Tourism 4 0 Webinar

-

ITB 2023

-

FITUR 2023

-

Small Talk with Mary Menchón - Mabrian Technologies

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific