Skyscanner reveals major travel trends 2026 at ITB Asia

At ITB Asia, Jarrod Kris, head of partnerships APAC Skyscanner, unveiled travel consumption’s latest trends and insights in its annual Edition Horizons Report.

Skyscanner’s report is based on a survey across 15 global markets and insights from the trends of its over 160 million monthly users. The company is is seeing a surge in traveler engagement, solidifying its role as a leading source of inspiration for air travel planning.

Skyscanner sits at the top of global flights web traffic, generating a share of 22.2%, followed by Google (15.9%) and Booking.com (6.3%). Flight searches continue to grow according to Kris who talks about a 10% increase in Skyscanner search volumes this year.

According to Skyscanner, 83% of travelers are globally planning to take more or the same number of trips in 2026 vs 2025. However, from more than 160 million monthly users exploring the platform, over half of them are undecided about where or when to go.“This is exciting as it creates a unique opportunity for our partners”, told Kris.

Regional Momentum and the Experience Economy

Globally, travel demand continues to strengthen. The Middle East leads regional growth with a 22% surge, fueled by increased connectivity and expanding fleets. APAC and Europe are growing around 9–10%, while North America sits at 3%. Despite regional differences, 83% of travelers globally plan to take as many—or more—trips in 2026 as they did in 2025, signaling a lasting appetite for experiences over possessions.

Spending priorities reflect that mindset: 71% plan to spend the same or more on flights, and 70% will maintain or increase accommodation budgets, with travelers emphasizing quality experiences over luxury for its own sake. Gen Z and Millennials are leading this spending shift, while Baby boomers remain more cautious in today’s economic climate.

Shifting Travel Behavior

When it comes to destination choice, the cost of flights and lodging remain top factors at respectively 58% and 57%. It is followed by food and drink (37%) and the cost of tourist attractions (33%). Meanwhile, travelers save on optional extras: seat selection or additional baggage are seeing softer demand.

Planning habits are also changing. Escapism and avoiding over-tourism are major drivers, with 26% of travelers seeking less crowded destinations. This is pushing tourism boards—such as Japan’s—to promote regional dispersal beyond hotspots like Tokyo toward Sapporo and Okinawa, highlighted Kris.

Meanwhile, 31% are choosing to travel during the shoulder season, attracted by lower costs and more authentic experiences. In APAC, for example, peak travel has shifted from summer holidays to October, supported by more flexible work policies that allow travelers to “work from anywhere.”

Data-Driven Insights and the Rise of Mobile-First Markets

Globally, the average lead time to book remains around 90 days, though markets like India stand out for their last-minute bookings. With the world’s lowest mobile data costs, India’s travelers are heavily mobile-first, responding quickly to deals and digital inspiration.

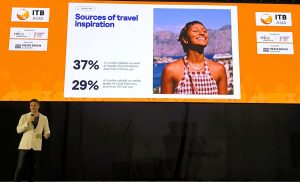

Despite the proliferation of technology, word of mouth remains the most powerful driver of travel decisions, followed closely by online media—with preferences shifting by generation: YouTube and Instagram for Gen Z, Facebook for Boomers, and TikTok growing across demographics.

AI boots travel consumption

Another important trend is the growing role play by Artificial intelligence in travel planning. Confidence in AI is rising quickly with 54% of travelers would use artificial intelligence for planning travel. Skyscanner showed that 38% of travelers are researching a destination on AI, 33% create a travel itinerary while 32% compare flight or hotel options and prices.

What’s Trending

Across APAC, Tokyo remains the top destination—thanks to cultural depth and a favorable exchange rate—as the yen hits record lows against the Singapore dollar. Seoul follows closely, while searches for Jaffna and Costa Rica are also climbing.

In Europe and the Middle East, London leads, while Bangkok continues to gain traction among European travelers. Brazil tops the Americas, followed by Spain and Tokyo, reflecting a growing intercontinental curiosity. In Latin America, Colombia and Argentina are trending, while Portugal shows long booking windows averaging 110 days.

Emerging Travel Trends for 2026

Skyscanner’s annual survey of 22,000 respondents highlights also seven major trends shaping next year’s travel mindset:

-

“Glow-up travel” – 60% of Gen Z travelers prioritize wellness and beauty experiences, from K-beauty pilgrimages to in-flight self-care.

-

Family Miles – Inter-generational trips are surging as travelers seek shared memories across age groups.

-

Altitude Shift – 71% are planning off-season mountain escapes focused on lakes and forests rather than ski resorts.

-

BookBound – Driven by BookTok’s 200 million TikTok views, travelers are visiting destinations featured in novels and shows.

-

Shelf Discovery – 73% enjoy exploring local grocery stores and everyday culture as a form of immersion.

-

The Backdrop Effect – Travelers increasingly choose stays that double as experiences, from luxury desert lodges to minimalist glamping.

-

Catching Flights and Feelings – 44% are open to meeting new people on trips, highlighting travel’s emotional and social dimensions.

Whatever trends are, Skyscanner predicts that travel demand will remain resilient and diverse in 2026. With Gen Z shaping trends through digital inspiration, social media, and spontaneous travel habits.

Skyscanner travel trends report should be available online on Friday October 17, 2025.

Related News Stories: Ryanair inks Skyscanner partnership Great Rail Journeys acquired

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Cyclone in Sri Lanka had limited effect on tourism in contrary to media reports

Euromonitor International unveils world’s top 100 city destinations for 2025