Dragon Trail International: China’s outbound is back… but it has changed

The Pacific Asia Travel Association (PATA) organized during WTM London 2025 an insight session on “Asia-Pacific Travel Trends 2025: What’s Next for Asian Travelers?”

Among various presentations was an in-depth portrait of the Chinese outbound market by Dragon Trail International. Based in Beijing and London, the marketing solutions company with roots in China has a deep knowledge of Chinese consumption habits, including in travel.

Sienna Parulis-Cook, Director of Marketing and Communications at Dragon Trail International conveyed some good news. China outbound is back and gaining strength again.

2025 Golden Week turned effectively into a milestone for Chinese outbound travel. The eight-day holiday at the start of October recorded nearly 10% year-on-year growth in international trips, marking one of the strongest rebounds since the pandemic.

According to Parulis-Cook, many signs point to a return to normalcy for China outbound tourism.

During COVID-19, China paused issuing new passports for leisure travel. But since passport offices reopened in early 2023, demand has surged. “Today, about 160 million Chinese citizens hold valid passports, a market share of around 11% of the total population. It is matching pre-pandemic levels. And also it leaves vast potential with enormous room for further expansion,” said Parulis-Cook.

Asia-Pacific leads the comeback

“The Asia-Pacific region remains Chinese travelers’ favorite playground. Proximity, affordability, and cultural familiarity make it the natural first step back into international travel,” told Parulis-Cook.

Japan tops the charts, boosted by a weak yen and easier visa processes. South Korea is catching up fast after introducing a visa waiver for group tourists in late September and adding new flights from smaller Chinese cities.

Further south, Malaysia and Singapore went visa-free for Chinese visitors in early 2023 and have seen surging arrivals — with Malaysia even surpassing pre-pandemic levels. Thailand, now visa-free as well, remains a strong destination although recovery has been hampered by issues over safety and potentially a Chinese “fatigue” for the destination. Vietnam, meanwhile, is riding a wave of renewed interest among travelers seeking something fresh.

Down under, Australia and New Zealand have not yet hit pre-2020 levels but are rebuilding steadily, supported by increased flight capacity and growing traveler confidence.

Europe remains THE dreamed destination for Chinese

Europe remains however the ultimate long-haul aspiration for many Chinese travelers. Traditional destinations — the UK, France, Italy, Germany, and Switzerland — are performing solidly. A strong emerging destination is Spain. “The country stands out as a post-pandemic success story, thanks to strong air links and sustained marketing,” described Parulis-Cook.

She also pointed to the recent appeal of Northern Europe as a rising star, with Norway and Iceland recording significant year-on-year growth.

New travel frontiers are the Middle East, North Afrca as well as Central Asia with increased air routes and tourism capacities. Central Asia — notably Kazakhstan and Uzbekistan — is booming, with eye-popping increases in flight capacity and arrivals.

All five nations across the Caucasus and Central Asia — including Georgia, Armenia, and Azerbaijan — now offer visa-free access to Chinese tourists.

South America remains a niche market due to distance, while North America has yet to rebound fully. However, China’s recent approval for outbound group tours to Canada may help shift that balance in 2025.

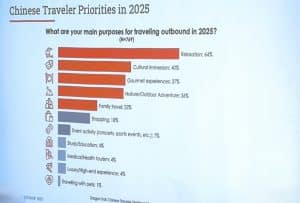

Travel purpose: Relaxation tops the list

A defining shift is happening in traveler motivation. In Dragon Trail’s April survey, nearly two-thirds of respondents said “relaxation” was their top reason for going abroad. It is a remarkable change for a market once known for whirlwind sightseeing tours.

Other leading motivators include cultural immersion, gourmet experiences, and nature and outdoor adventure. Shopping, by contrast, has dropped in priority.

“Chinese travelers today are looking for richer experiences and greater comfort. And not just souvenirs,” said Dragon Trail International Director of Marketing and Communications.

The market is also more budget-conscious. However, it doesn’t mean travelers are spending less. Instead, they’re seeking value by investing in better hotels, dining, and authentic experiences.

Another shift is also taking place: the traditional Chinese group tour is giving way to FIT travels. In Dragon Trail’s August survey, 56% of respondents said they would travel independently, compared to just 27% who preferred group tours.

Among the youngest generation (ages 18–24), the preference for independent travel soars to 71%. Still, group travel remains relevant, especially among older travelers or for niche destinations.

Group sizes are also getting smaller, being now around 20 people or even fewer.

Permanently on digital tools, from booking to visiting

When it comes to travel inspiration, Chinese social media reigns supreme. WeChat, Weibo, Douyin (China’s TikTok), and Xiaohongshu (Little Red Book) are the top sources of ideas told Parulis-Cook.

For planning and booking, OTAs like Ctrip and Fliggy continue to dominate, especially among travelers aged 35 and older. Younger travelers, however, are more likely to research destinations on social media first.

Influencers play a crucial role: 86% of Chinese travelers follow travel influencers, and more than half say these voices influence their travel plans — mainly for practical advice rather than just aesthetics.

When booking, over 50% of travelers use OTAs for flights, while 30% go directly to airlines and 14% still rely on offline agents.

Once they arrive, Chinese tourists stay digitally connected. They use Red Book for real-time tips, Dianping for restaurant and attraction reviews, and WeChat Mini Programs for navigation and local information. Payments are seamless with Alipay and WeChat Pay.

They’re also prolific sharers. 94% of Chinese outbound travelers post about their trips online, and over one-third share daily. WeChat Moments is the top platform, followed by Red Book and Douyin — feeding an endless cycle of peer-to-peer inspiration. “Every post becomes part of a new wave of trusted travel recommendations,” highlighted Parulis-Cook.

Related News Stories: Visit Lauderdale - TravelMole Abercrombie & Kent - TravelMole

Have your say Cancel reply

Subscribe/Login to Travel Mole Newsletter

Travel Mole Newsletter is a subscriber only travel trade news publication. If you are receiving this message, simply enter your email address to sign in or register if you are not. In order to display the B2B travel content that meets your business needs, we need to know who are and what are your business needs. ITR is free to our subscribers.

Phocuswright reveals the world's largest travel markets in volume in 2025

Higher departure tax and visa cost, e-arrival card: Japan unleashes the fiscal weapon against tourists

Singapore to forbid entry to undesirable travelers with new no-boarding directive

Euromonitor International unveils world’s top 100 city destinations for 2025

U.S.A. and Israel attacks on Iran impact air movements in the Gulf (Update 1.00pm CET)