About us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis. Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions. Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms. Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity. Spend at destination: we analyse patterns of ...Read more

Mabrian Technologies - About Us

We work with reliable data providers with global coverage, that guarantee data representativeness as well as compliance with International Personal Data Protection laws. Our data sources are as varied as the different modules we offer for tourism analysis.

- Tourist Behaviour: we analyse spontaneous interactions on Social Media and Opinion platforms related to the tourism sector in order to extract indicators based on visitors’ interests and perceptions.

- Accommodation offer for a specific destination (hotels and alternative accommodation): we work with data from OTAs (Online Travel Agencies) and tourism reservation platforms.

- Air Connectivity: we analyse patterns related to air schedules, flight searches, flight bookings via data from the main GDSs (Global Distribution System) and companies specialised in monitoring air connectivity.

- Spend at destination: we analyse patterns of Spend for visitors to a destination based on credit and debit card usage (or equivalent digital means). This data comes from the main providers of payment channels.

- Presence and mobility: we monitor presence and mobility of visitors through their mobile devices’ connectivity to antennas located in the destination. This data comes from mobile network companies that are present in the destination.

Company Name : Mabrian Technologies

News & announcements

-

28 Dec 23

Partner News

New motivations for travel in Europe: trending destinations in 2024Experiential travel as a motive for a holiday has increased by 8 percentage points ...Read moreNew motivations for travel in Europe: trending destinations in 2024 - News & announcements- Experiential travel as a motive for a holiday has increased by 8 percentage points globally since 2019, with motivations to visit Europe following a similar pattern.

- Northern European countries are better positioned to capitalize on these new demand trends.

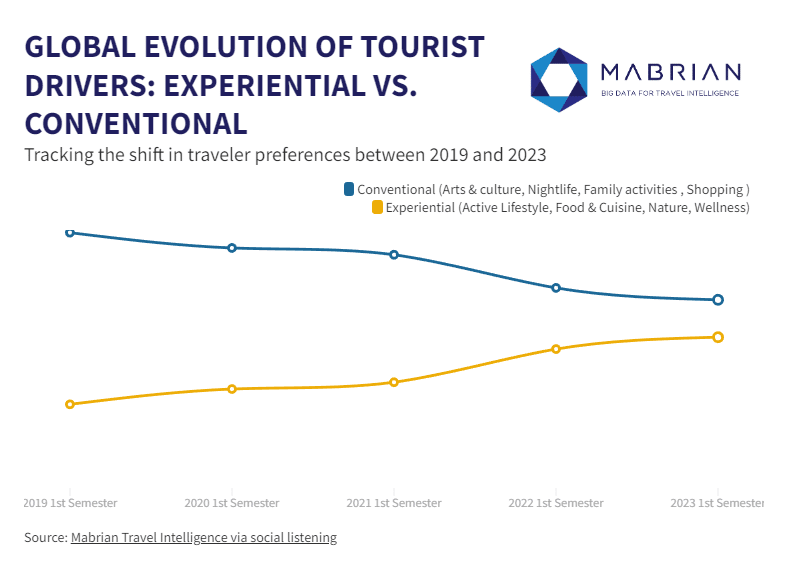

- Towards experiential travel: Mabrian's analysis indicates a global trend towards more experiential and less conventional travel motivations, with an 8% increase in experiential travel since 2019. Experiential tourism encompasses activities such as active, natural, gastronomic, and wellness experiences, while conventional tourism includes culture, sun and beach, family activities, nightlife, and shopping.

- New european trends reflecting global change: Europe has experienced an equivalent 8% growth in experiential activities from 2019 to 2023, reducing the prominence of conventional motivations. Active and nature tourism emerge as the fastest-growing, gaining 5 and 3 percentage points, respectively.

- Countries best positioned for experiential tourism: Countries in Northern Europe, including Iceland, Norway, Finland, Slovenia, and Switzerland, are better positioned to capitalize on the growing demand for experiential activities, with a share of over 60% in visitor interest.

- Potential trending destinations for 2024: Mabrian identifies Italy as the leading country with the most potential destinations (four), followed by France and Germany with two each. The top 10 trending regions for 2024 also include the United Kingdom and Portugal.

- Piedmont Region, Italy: Notable for destinations like Turin, Stresa, and Alba, Piedmont stands out with a balance of cultural and natural offerings. Gastronomic experiences feature prominently among experiential motivations, coupled with positive trends in flight accessibility.

- New Aquitaine, France: Featuring destinations such as Bordeaux, Biarritz, and Limoges, this region stands out for its oenological and gastronomic products alongside active tourism. The region enjoys good and stable air connectivity.

- East of England, United Kingdom: Including Cambridge, Essex, and Norfolk, this region achieves a balance between cultural and natural offerings, positioning it as a growing destination. Its solid and stable connectivity further supports its appeal.

- To complete the top 10 trending destinations, notable mentions include: Occitania (France), Campania (Italy), North Rhine-Westphalia (Germany), Lombardy (Italy), Emilia-Romagna (Italy), the province of Hamburg (Germany), and the province of Lisbon (Portugal).

-

16 Nov 23

Partner News

Croatia forecasts a 10% growth in tourism for this low season – Mabrian TechnologiesCompared to last year, Croatia anticipates higher tourism activity during the autumn and winter ...Read moreCroatia forecasts a 10% growth in tourism for this low season – Mabrian Technologies - News & announcements- Compared to last year, Croatia anticipates higher tourism activity during the autumn and winter months, with specific months showing an increase of more than 20%.

- A Seasonal Context with Room for Improvement. Croatia still has room for improvement during the considered low season months. When compared to the context and its closest competitors, the data indicates that the Southeast Mediterranean region is 9 percentage points more dependent on the high season than the average in the nearby Mediterranean, while Croatia is 16% more.

- Promising Prospects for the Low Season. One of the main takeaways from Mabrian's analysis is the promising outlook for Croatia in the coming months. It forecasts a 10% increase in tourism from September to March 24, compared to last year. In terms of growth, Croatia is expected to outperform Italy and Turkey during these months, although it has not yet reached the levels seen in Greece.

- Croatia Well Positioned for Travellers’ Motivations. According to the latest global travellers’ motivations study conducted by Mabrian, there is a consistent growth in experiential motivations for travel, substituting more conventional motivations. Analysis of travellers sentiment and preferences, based on over 400 million interactions on social media, reveals that interests in Active, Natural, Wellness, and Gastronomy experiences are gaining importance over Sunbathing, Family Travel, Shopping, and Nightlife. This positions Croatia with a great opportunity to solidify its leadership in Nature and Active tourism products during the low season, compared to Mediterranean competitors. Additionally, there is an interesting opportunity to further develop Gastronomy and Culture-related activities, which were among the main travellers interests from October to March during the Autumn-Winter 2022-2023 season.

-

13 Oct 23

Partner News

Hotel rate rises: how much is too much? Mabrian TechnologiesThis summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B ...Read moreHotel rate rises: how much is too much? Mabrian Technologies - News & announcements- This summer travellers booked hotels at never-before-seen prices. How can travel sellers and B2B distributors respond? What role does tech play?

- Data from travel intelligence provider shows 2023 August prices for hotels were up by 64.03% in North America when compared to 2019.

-

21 Aug 23

Partner News

Experiential travel replaces conventional motivations for travel – Mabrian TechnologiesMabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019 ...Read moreExperiential travel replaces conventional motivations for travel – Mabrian Technologies - News & announcements- Mabrian analyzes the evolution of traveller behavior and their motivations for travel since 2019

- ‘Experiential’ definition includes activities such as Wellness, Active & Lifestyle, Nature & Food and Cuisine.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

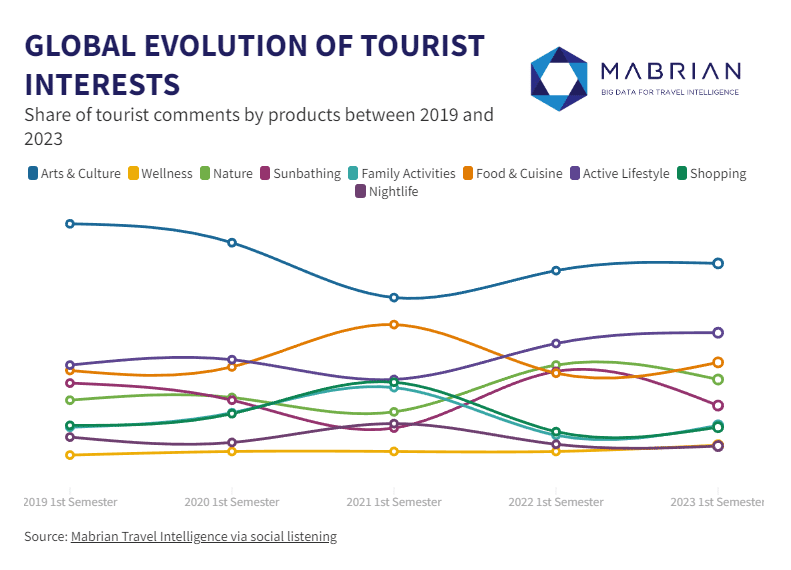

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

GRAPH: EXPERIENTIAL VS CONVENTIONAL

The activities that have picked up the most during these years reaching unprecedented levels of interest are Active & Lifestyle, Nature and Wellness. Regarding the two first ones, the data shows a clear inflection point from 2021, corroborating the effects of the pandemic in this type of motivations to travel. Wellbeing has also seen stable growth since 2019.

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

GRAPH: Global evolution of Tourist Interests: lines graph

On the other hand, conventional activities that have lost most of their importance are Arts & Culture and Sunbathing, which now represent only 34% of travel motivations, losing 7 percentual points since 2019.

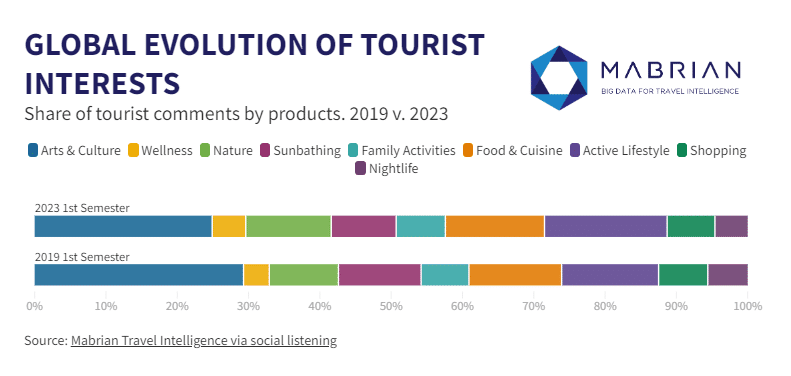

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination.

GRAPH: Global evolution of Tourist Interests: bars

Carlos Cendra, Chief Marketing and Communication Officer at Mabrian comments: “the way we travel is constantly switching. From the traditional holidays of sunbathing in coastal destinations and culture and shopping in the cities, to disconnecting and discovering experiences where the connection with the environment and ourselves is key. There’s an obvious impact of the pandemic and the effect of being locked down that made us realise how important it is to enjoy the outdoors and feel well and healthy during our free time which has stuck in travellers’ motivations”.

Mabrian highlights that it is essential for destinations and tourism companies to detect new global trends among travellers in an agile manner, while working to offer a tourism product that is as diversified as possible and in line with new trends. High dependence on specific tourism products causes inefficiencies related to high dependence on certain source markets and high seasonality patterns. These factors are of great importance when it comes to promoting the sustainability of the destination. -

24 Jul 23

Partner News

Mabrian enters next phase of strategic growthMabrian announces strategic growth plan as part of evolution to become the number one ...Read moreMabrian enters next phase of strategic growth - News & announcements- Mabrian announces strategic growth plan as part of evolution to become the number one travel intelligence tool globally.

- In addition to the Middle East and North America push the company will also expand further into providing services to hotels, airlines and other private sector businesses.

- Diana Munoz joins Mabrian as a Strategic Advisor to lead the company’s new strategy and contribute to its growth.

-

04 Apr 23

Partner News

Mabrian: Hotel price rises for Easter are not just a question of inflationAverage hotel prices for Easter are increasing in all 20 destinations analysed and, in most cases, far ...Read moreMabrian: Hotel price rises for Easter are not just a question of inflation - News & announcements- Average hotel prices for Easter are increasing in all 20 destinations analysed and, in most cases, far above the rate of inflation.

- Only a few exceptions are detected in Naples, Tirana, and Budapest, where 5-star hotel prices have decreased slightly.

- In Barcelona, Brussels, and Rome, hotel prices have increased by an average of 30% to 33%, whereas Zagreb, Warsaw, and Tirana have the lowest prices for all three hotel categories during Easter.

-

20 Jan 23

Partner News

The fastest growing source markets with flights to Madrid for 2023Mexico and Colombia lead the destinations with the highest growth in air capacity to ...Read moreThe fastest growing source markets with flights to Madrid for 2023 - News & announcements- Mexico and Colombia lead the destinations with the highest growth in air capacity to travel to the Spanish capital in 2023

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico.

In addition to the data on growth in air capacity, the origin destinations that will visit Madrid the most, in order, will be: the Spainish domestic market to Madrid, followed by Italy, France, Portugal, the United Kingdom, the United States, Germany, Mexico, Colombia and Swizterland.

In this ranking there are changes compared to 2019, when the United Kingdom was in fourth place followed by Germany, and Mexico was in last place. Thus, in 2019, the destinations that visited Madrid the most were: Spain, Italy, France, the United Kingdom, Germany, the United States, Portugal, Switzerland, Colombia and Mexico. -

01 Nov 22

Partner News

The footprint of American tourists visiting Spain in summer 2022Half of the Americans who visited Spain in summer 2022 came mainly from 10 ...Read moreThe footprint of American tourists visiting Spain in summer 2022 - News & announcements- Half of the Americans who visited Spain in summer 2022 came mainly from 10 cities – and within these cities, the demand was concentrated in only three or four specific neighborhoods

- New study from leading tourism intelligence company Mabrian analyzes the footprint oftourists from the United States visiting Spain during 2022

- Approximately 50% of US visitors were over the age of 35, had a median salary of over $75,000, and were university educated.

-

30 Aug 22

Partner News

Could climate change mean that winter becomes the new summer in travel? – Mabrian TechnologiesWhen it comes to climate change the travel industry needs to change its approach ...Read moreCould climate change mean that winter becomes the new summer in travel? – Mabrian Technologies - News & announcementsWhen it comes to climate change the travel industry needs to change its approach to ‘summer holidays’ if it doesn’t want to get caught out in the cold ‘Winter is coming’ is the Stark family’s moto in Game of Thrones and in the travel industry this might be the case when it comes to ‘summer holidays’ due to climate change. This year saw heat records broken in most of the main European summer tourism destinations, in some cases by quite significant margins, and climate experts are predicting that many places popular with tourists soon will be scorching hot every summer. What does this mean for a tourism industry largely based around summer peak season visitors? Could winter become the new summer or will tourists start visiting new destinations where the climate is more bearable? We spoke with six experts to find out more. Carlos Cendra, Sales and Marketing Director at travel intelligence provider Mabrian says: “If anyone thinks that hotter weather is good news for beach traditional beach destinations then they should think again. During this summer’s heat wave in Europe we saw a clear drop in visitor satisfaction levels during the hottest weeks. The weather is one of the most important contextual factors for the tourism industry. Hundreds of vacational destinations in the Mediterranean and North Africa have traditionally based their tourism development on favorable weather conditions. Now this is changing, and faster than we thought. This is probably going to change global travel trends within the next years, so we’d better analyze the effects of this on the expectations and preferences of travellers.” Matthew Chapman, CTO of travel booking technology provider Vibe comments: “Online travel agents and other digital points of sale for travel should consider adding a filter that lets people search by average temperatures for the dates they are looking. Likewise hotels, experiences providers, perhaps even airlines and airports should all start considering populating their content with information about air conditioning, shaded areas, and so on – and make that content searchable and filterable in the booking process. More and more people will be concerned by such details at the search and booking stage.” Alex Barros, Chief Marketing and Innovation Officer from Beonprice, the revenue management & total profitabilty platform for for the hospitality sector, adds: “From a revenue management perspective for hoteliers this is a potentially enormous change as pricing for leisure travel has all been defined by the same summer peak season approach since the beginning of mass tourism in the 1960s. More research will be needed around how temperatures impact consumer demand. What is the ideal temperature for maximum pricing? Is it impacted by temporary volatility in temperatures, or just long-term averages? All of this will of course impact how hoteliers approach building and opening new properties too, not just location but temperature-controlled buildings and communal areas.” Fabián Gonzalez, Co-Founder of Forward_MAD, a luxury tourism event taking place in Madrid from 5th to 7th October, says: “Luxury hotels and resorts, and luxury experiences generally, are better positioned to adapt to the challenges of climate change as they have the resources to invest in what is needed – better climate controlled buildings, air conditioned transfers, and so on – and have more demanding clients in terms of sustainability expectations, who are prepared to pay for this. Contrast that with mass-market tourism providers with low-margins where such costs would be the difference between profit and loss. Additionally a shift towards tourists spreading their holidays out throughout the whole year, adapting to ‘wintering’ rather than ‘summering’, could suit many boutique and smaller luxury hotels with only a limited number of rooms – allowing them to fill them up in the normally quieter months. Not least as high spending travellers normally are more flexible in terms of vacation dates anyway.” Bruno Martins, Senior Product Manager from the global hospitality technology provider Shiji Group comments: “Hotels and resorts in hotter locations will have to re-think their outdoor relaxation areas, perhaps putting an end to ‘outside’ pools or at the very least placing some kind of cover over the top – and making them more nighttime friendly too, including lifeguard services, or perhaps even charging for peak hours. Equally the spa centres should be rethought, positioning them more as a place to go and cool down – with less saunas and more ice baths. Golf courses are a popular draw for hot locations and they too will be impacted, quite heavily in fact as you can’t cover a whole golf course with screens and more watering will be required at a time when water becomes more scarce. Again nighttime, or at least early morning, tee-offs will be in greater demand. Technology is going to be the golden-thread throughout all of these changes, whether that be via apps that allow guests to schedule better those precious cool moments, pricing software that maximizes revenues based on temperature, or electronic wrist bands that allow guests access (or not!) to certain locations at certain times based on demand. Basically hotels can already start optimizing revenue for the activities based on time of day, where demand will increase and improve revenue management of rates.” Janis Dzenis, Director of PR for the recently launched flight price comparison website WayAway also says: “For many US travellers going to Europe, summer is still all about the Mediterranean region and that might take a long while to change no matter how hot it becomes. Especially keeping in mind that for many US visitors to Europe this is a one-off, special trip – they aren’t basing their choice on previous experiences, but on what they saw in a movie or a friend told them. Any reality will take time to filter through. However in the short term all this recent hot weather around the world is driving eco-consciousness amongst travellers. So they´ll want to know what destinations and hotels are doing to fight this and those that don’t have a convincing answer will gradually lose out. This will also drive more demand for travellers to offset their carbon footprint too and this is a service we offer to our WayAway Plus subscribers, one that is proving very popular.” -

25 Jul 22

Partner News

Dollar to euro parity: what does this once-in-20-years ‘gift’ mean for European hoteliers and destinations? Mabrian TechnologiesData from travel intelligence provider Mabrian shows correlation between exchange rate and search demand ...Read moreDollar to euro parity: what does this once-in-20-years ‘gift’ mean for European hoteliers and destinations? Mabrian Technologies - News & announcements- Data from travel intelligence provider Mabrian shows correlation between exchange rate and search demand from US source market

- Mastercard confirms that American travellers in Spain spend twice the amount other European travellers do

- Luxury tourism event Forward_MAD calls this a ‘gift not to be missed’ for hoteliers concerned about the post-September outlook

- Polling from US metasearch company WayAway shows that almost half of Americans now more keener to travel to Europe as a result of parity

- Revenue management experts Beonprice provides hoteliers with tips on how to market themselves

- Almost half (49%) are now keener to travel to Europe than before as a result of the dollar to euro parity.

- The area where they felt they are most likely to benefit from this change is in shopping (63%) closely followed by dinning out (60%).

- From which US cities are they getting demand?

- How far in advance do their US customers typically book?

- Which channels are they using to buy?

- And finally which products (room types, rate types etc,) are the most popular?

-

07 Jul 22

Partner News

Mabrian reinforces its team to accelerate its expansion in Europe, the Middle East and Latin AmericaIncorporation of four people to enhance the company’s presence in different regions to offer ...Read moreMabrian reinforces its team to accelerate its expansion in Europe, the Middle East and Latin America - News & announcements- Incorporation of four people to enhance the company’s presence in different regions to offer solutions based on tourism intelligence.

- The team has grown by 20% since 2021, now forming a total of 27 people.

- Mabrian now has a multicultural team with 11 nationalities speaking 10 languages.

- Chris Ramaciotti is the new Business Development Manager for Northern Europe. He has an international MBA and extensive experience in the luxury hotel sector. For Chris, “the technology developed by Mabrian is a central element when it comes to meeting the needs of a traveler since we accompany destinations and companies so that they can better understand their behavior and adapt their strategies”.

- While Parisa Bakhtiari is the new Business Development Manager for the Asia, the Middle East and Africa areas. A telecommunications engineer with a background in tourism, she has spent many years of her career focused on the travel industry. “I am passionate about exploring data in tourism, and with this passion I am dedicated to facilitating the incorporation of tourism intelligence in tourism policies and strategies, whilst helping the sector to take advantage of the opportunities of big data.”

- Mary Menchón is Mabrian’s Business Development Manager for Spain, Portugal and LATAM. Trained in tourism andcommunication, her work experience has focused on the tourism sector from different perspectives. “At Mabrian, a company that I have known since 2018, I know how to provide the vision of working and implementing the use of big data for DMO’s from scratch, since I myself experienced that process. For me, being able to help tourist destinations implement this tool and being able to continue contributing my part for the recovery of tourism is my greatest motivation”.

- And Catalina Taltavull is Mabrian’s new global public procurement coordinator. She has a mixed profile between aeronautical engineering, business development and extensive experience in the tourism and accommodation sector. Her functions at Mabrian are summed up in her own words: “We are facing the birth of a new service sector for tourism managers: Tourism Intelligence. The highly unstable context that the sector is facing makes administrations increasingly see the need to professionalize and have information to make better decisions. At Mabrian what we have is a solution developed and approved with more than five years of experience in the market, ready to provide an agile solution to the sector.”

-

30 Jun 22

Partner News

Research from Mabrian: Outbound USA travel forecast for the 4th of July weekendCountries ranked according to US demand for international travel during the 4th July long weekend ...Read moreResearch from Mabrian: Outbound USA travel forecast for the 4th of July weekend - News & announcementsCountries ranked according to US demand for international travel during the 4th July long weekend This coming Monday 4th of July is Independence Day in the United States and many Americans, taking advantage of the fact that the holiday falls on a Monday, will celebrate it by traveling to international destinations. Mabrian, the leading tourism intelligence company, has analyzed the outlook for trips from the United States to the main international destinations using their own Mabrian indicator that measures the strength of market demand for a destination based on searches. The conclusions that have been drawn are the following:- Mexico is the destination that arouses most interest from Americans to travel to during these dates, with a score of 36.0 per million searches.

- Spain is the next country in terms of demand, among the countries analyzed, and the first among the European destinations analyzed for this study, with a score of 20.5.

- Portugal (13.1) exceeds Greece (11.7) in terms of demand, with Italy at (10.3) and France (9.6). Whilst at the bottom of the list is the Dominican Republic (9.5).

VIDEOS

Exploring Future Trends: Insights from World Travel Market 2023

Join us at the World Travel Market 2023 as we delve into the latest travel trends and technological advancements shaping the industry. We had insightful discussions with international experts in generative AI, blockchain, and legal regulations.

Travel motivations are evolving towards more experiential pursuits. There is an exciting atmosphere and optimistic outlook for the travel sector, especially in Southern Europe and the UK market.

We also share our participation in the WTM Global Trends report, offering a glimpse into the transformative intelligence shaping the future of travel.

💎 https://mabrian.com/

🖊️ https://blog.mabrian.com/

📫 [email protected]

🐦 https://twitter.com/MabrianOfficial

Travel intelligence platform for tourism industry. Real time data observatory providing flights data, hotel data, spend data, tourist sentiment and perception data. Predictive insights for Smart Destinations, Tourist Marketing and Revenue Management.

Travel motivations are evolving towards more experiential pursuits. There is an exciting atmosphere and optimistic outlook for the travel sector, especially in Southern Europe and the UK market.

We also share our participation in the WTM Global Trends report, offering a glimpse into the transformative intelligence shaping the future of travel.

💎 https://mabrian.com/

🖊️ https://blog.mabrian.com/

📫 [email protected]

🐦 https://twitter.com/MabrianOfficial

Travel intelligence platform for tourism industry. Real time data observatory providing flights data, hotel data, spend data, tourist sentiment and perception data. Predictive insights for Smart Destinations, Tourist Marketing and Revenue Management.

-

Exploring Future Trends: Insights from World Travel Market 2023

-

Mabrian at the Tourism Innovation Summit, Seville - A World for Travel sustainability award

-

An Inside Look at Mabrian Technologies' Growth Strategy with Diana Munoz, Strategic Growth Advisor

-

Travel intelligence and smart pricing management - Project Tourism 4 0 Webinar

-

ITB 2023

-

FITUR 2023

-

Small Talk with Mary Menchón - Mabrian Technologies

United Kingdom

United Kingdom United States

United States Asia Pacific

Asia Pacific